The Truth About Investment Returns Wall Street Won’t Tell You

One of the most common smoke screens in the financial world is the difference between average returns and actual returns. You’ve heard it before: “This investment averages 10%” or “Our fund averages 12%.” On paper, that sounds promising. In practice, it means very little.

Average returns are marketing. Actual returns are reality. The two are rarely the same.

A Simple Example That Exposes the Lie

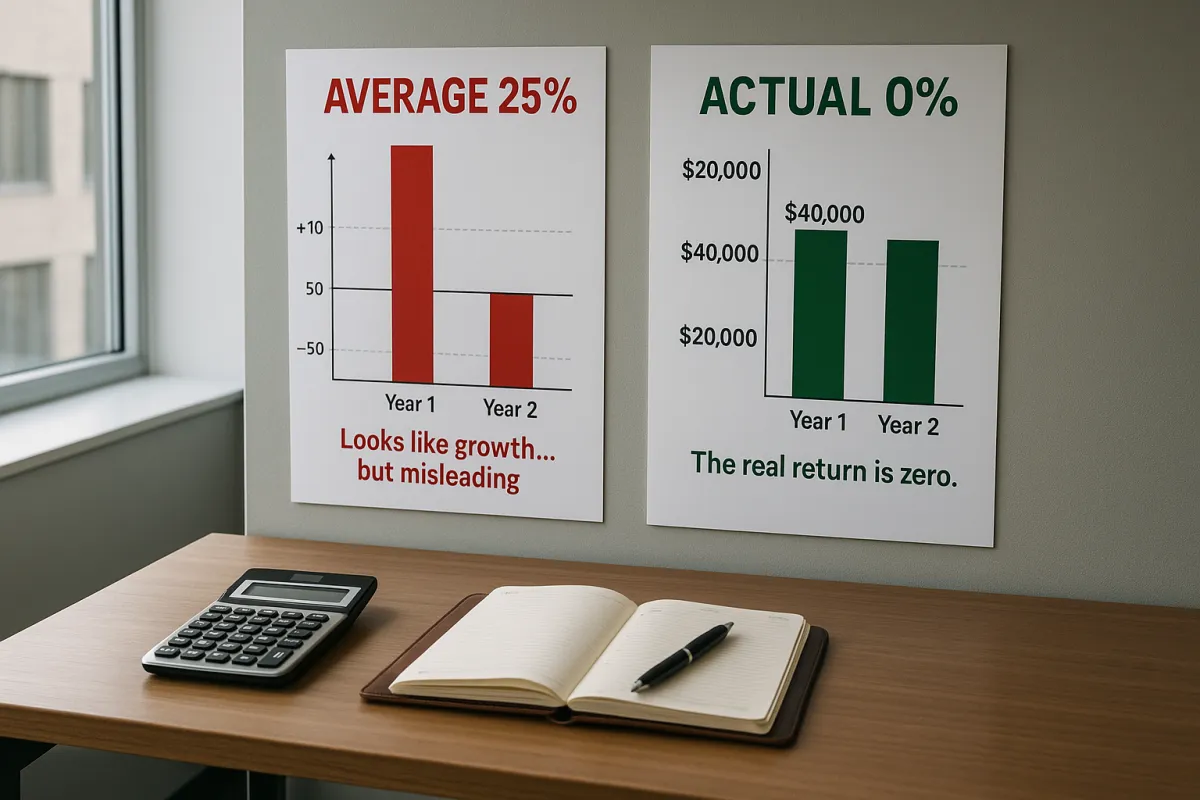

Imagine you invest $20,000. In year one, the investment doubles and you earn 100%. Your balance is now $40,000. In year two, the investment loses 50%. Your $40,000 falls back to $20,000.

Over two years, your average return is 25%. The math works like this: 100% gain minus 50% loss equals 50. Divide by 2 years and you get 25%.

But your actual return is zero. You ended right where you started.

This is why focusing on averages is dangerous. They paint a picture that can be spun for marketing, while the investor may not see any real profit at all.

The Net Return Is What Matters

Beyond volatility, you must also consider management fees, advisor costs, and taxes. Even when returns are positive, those expenses reduce your actual outcome. The only question worth asking is: what am I netting?

This applies in other areas as well. In the insurance space, you may hear “your policy earns 5% to 6%.” But that is before internal costs, fees, or charges. Once again, the actual return is what matters.

Clarity only comes when you dig beneath averages and ask the hard question: how much money did I actually make?

Why This Matters for Christian Investors

Stewardship requires honesty. Averages can mislead, creating false confidence about future outcomes. Actual returns reflect reality, and only reality can support wise financial decisions. Proverbs warns against dishonest scales. Average returns are the financial industry’s version of a dishonest scale.

To build a lasting financial legacy, you need more than projections that sound good. You need clarity on what your dollars are truly earning. When you focus on actual returns, you guard your household, strengthen your stewardship, and protect your retirement from false expectations.

If you are ready to explore financial strategies that provide real, guaranteed results, not smoke screens, book a discovery call today.