How Market Losses Impact Your Retirement

When you understand the math behind losses and the risks that come with withdrawing money during down years, you can design a retirement plan that is far more stable and predictable.

When you understand the math behind losses and the risks that come with withdrawing money during down years, you can design a retirement plan that is far more stable and predictable.

Every year, business owners work hard to build profit, only to watch a large portion disappear to taxes or sit idle in low-yield accounts. It is the cycle most entrepreneurs fall into: reinvest, save, or surrender a big check to the IRS. Few stop to ask a simple question: Is there a better way to use this money?

Whole life insurance can be a powerful asset when structured properly, but there is one reality many agents fail to emphasize. In the early years, you will lose money.

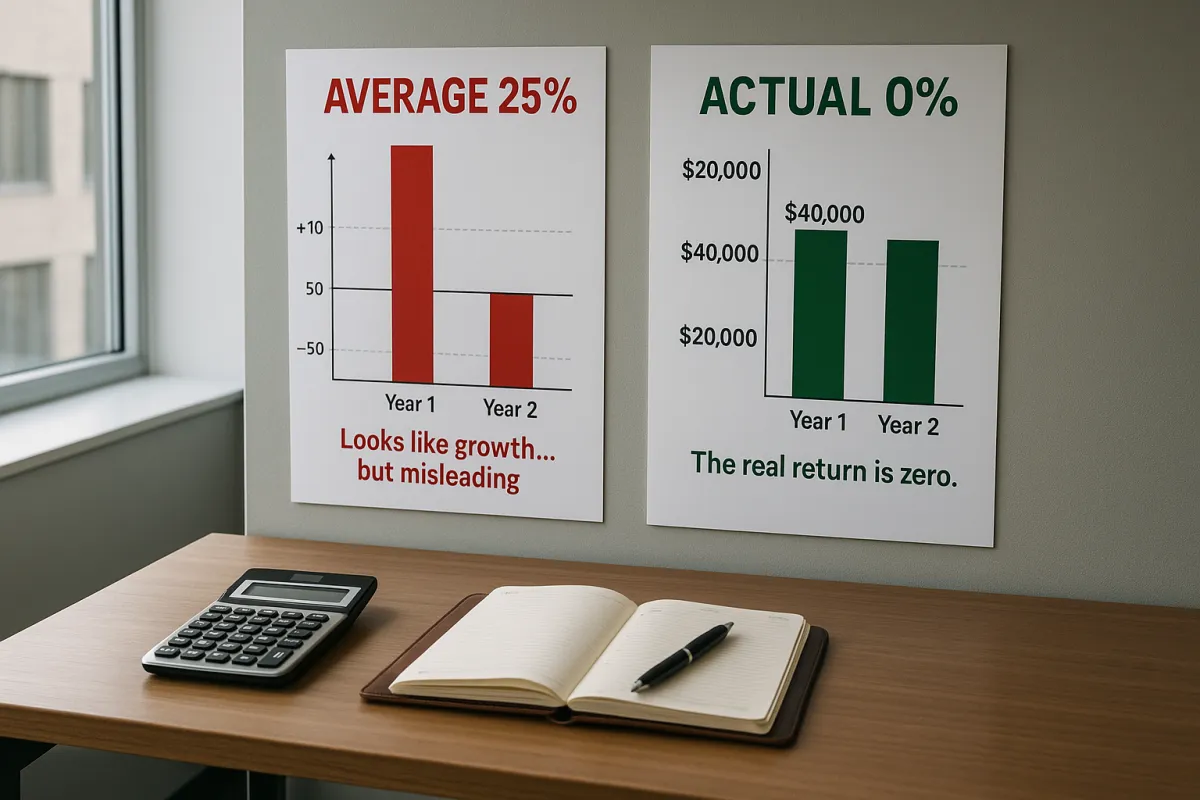

One of the most common smoke screens in the financial world is the difference between average returns and actual returns. You’ve heard it before: “This investment averages 10%” or “Our fund averages 12%.” On paper, that sounds promising. In practice, it means very little.

© 2025 The Hidden Reserve. All Rights Reserved.